Jul 16, 2024

El Brent supera los $86 ante un recorte de la Reserva Federal en Septiembre

El crudo Brent se disparó a 86 dólares por barril luego de que datos de inflación estadounidenses mejores de lo esperado despertaron esperanzas de un recorte de tasas de la Reserva Federal en Septiembre

July 12th, 2024

A principios de esta semana se produjo una ligera corrección a la baja en los precios del petróleo, y los daños previstos por el huracán Beryl resultaron ser menos impactantes de lo que se suponía inicialmente; sin embargo, datos macroeconómicos constructivos han revertido esa caída. Con la caída de los precios al consumidor en Estados Unidos el mes pasado por primera vez en cuatro años, el recorte de las tasas de interés de septiembre se convirtió en un evento de alta probabilidad para la Reserva Federal, elevando el ICE Brent por encima de los 85 dólares por barril nuevamente.

IEA Sees Global Demand Weakness. The IEA reported the lowest quarterly increase in global demand in over a year as consumption rose by 710,000 b/d in Q2, saying that China’s stellar growth is coming to an end and cutting the 2025 outlook further to 970,000 b/d.

Indian State Refiners Seek Russian Term Deals. India’s Prime Minister Narendra Modi visited Russia this week, accompanied by representatives of the country’s state-controlled refiners seeking to sign long-term import deals with Russian exporters, finalizing terms such as payment currency.

South Africa Seeks to Salvage Grounded Ship. The Panama-flagged dry bulk tanker Ultra Galaxy carrying ammonium nitrates to Dar es Salaam in Tanzania ran aground off South Africa’s coast, raising the risks of a potential oil spill and pollution as salvage operations are hampered by rough sea conditions.

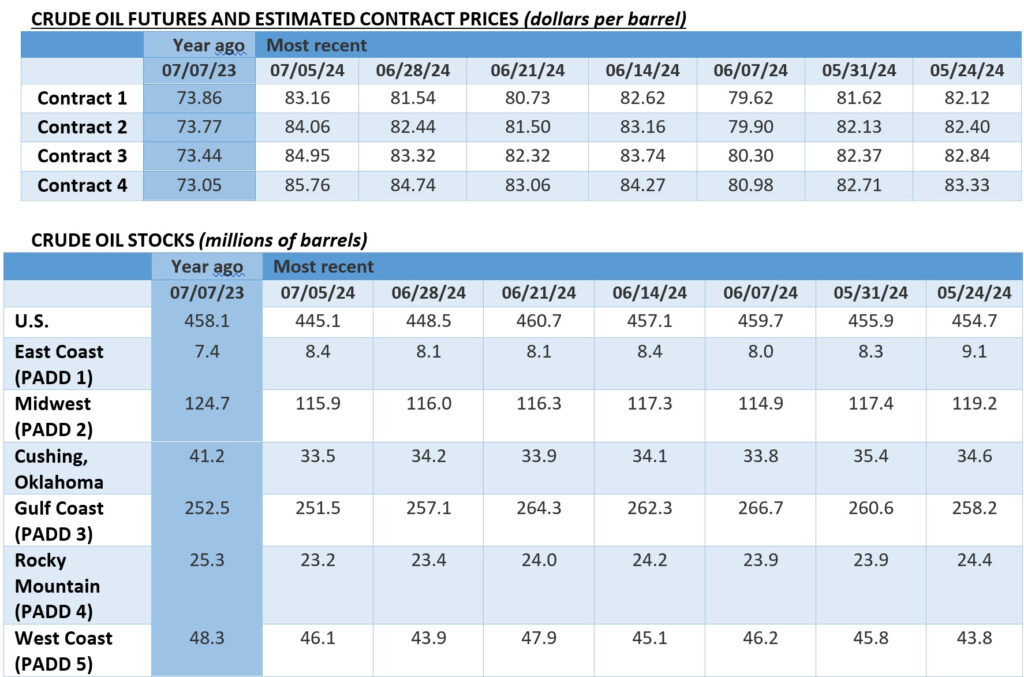

Taking Its Chances, US Seeks Q4 SPR Volumes. Having failed to purchase any SPR volumes below $80 per barrel in its last tender, the US Energy Department seeks to purchase up to 4.5 million barrels of oil to its Bayou Choctaw site in Louisiana, to be delivered from October through December.

Saudi Aramco Taps into Bond Market. Saudi Aramco (TADAWUL:2222), the national oil company of Saudi Arabia, attracted more than $31 billion of orders for its $6 billion bond sale, its first foray into the debt markets in three years, selling 10-, 30- and 40-year dollar-denominated bonds.

Rio Tinto’s Lithium Project Back on Track. Australian mining giant Rio Tinto (ASX:RIO) welcomed the Serbian constitutional court’s ruling this week that overturned the government’s 2022 decision to scrap the planning permission for Europe’s largest lithium mine, the Jadar project opposed by local environmentalists.

US Natural Gas Demand Soars Amidst Heatwaves. Power generators across the United States burned a record amount of natural gas this Tuesday, the hottest day of 2024 so far, some 54.2 billion cubic feet per day, surpassing the previous record of 52.8 Bcfd from July 2023.

More Bearish Than Ever, BP Sees Oil Peak in 2025. Publishing its annual Energy Outlook, UK energy major BP (NYSE:BP) announced it expects oil demand to peak in 2025 already at 102 million b/d in both its ‘Current Trajectory’ and ‘Net Zero’ scenarios, maintaining a bearish outlook on fuel consumption.

US Slaps Record Penalty for Air Pollution. The US Department of Justice fined Marathon Oil (NYSE:MRO) over alleged air pollution violations at the company’s oil and gas facilities on a North Dakota Indian reservation, with the oil producer agreeing to pay a $241 million settlement.

Gulf Coast Moves Past Hurricane Beryl. The US Army Corps of Engineers and the US Coast Guard gave the all-clear for the full reopening for the port of Houston this Thursday, lifting all draft restrictions, with other Texas ports expected to resume normal operations on July 12.

China Tightens Rules for Solar Manufacturers. China’s industry ministry issued draft rules for the solar photovoltaic industry seeking to limit the past year’s overcapacity problem, requiring a minimum capital ratio of 30% for new projects and stipulating minimum efficiency levels.

UK Court Scraps Onshore Drilling Approval. The United Kingdom’s Supreme Court reversed a 2023 decision to grant permission for an onshore well in Lincolnshire, one month after taking a similar decision over a prospective oil well near Gatwick Airport, quashing the outlook for all onshore projects.

Tanker Seized by Iran Moving Again, Without Cargo. The Marshall Islands-flagged tanker Advantage Sweet, seized by Iran more than a year ago with its 1-million-barrel cargo of Wafra crude confiscated by Tehran, is heading towards international waters after being released this week.

Tom Kool

Editor, Oilprice.com